關(guān)于我們 / about us

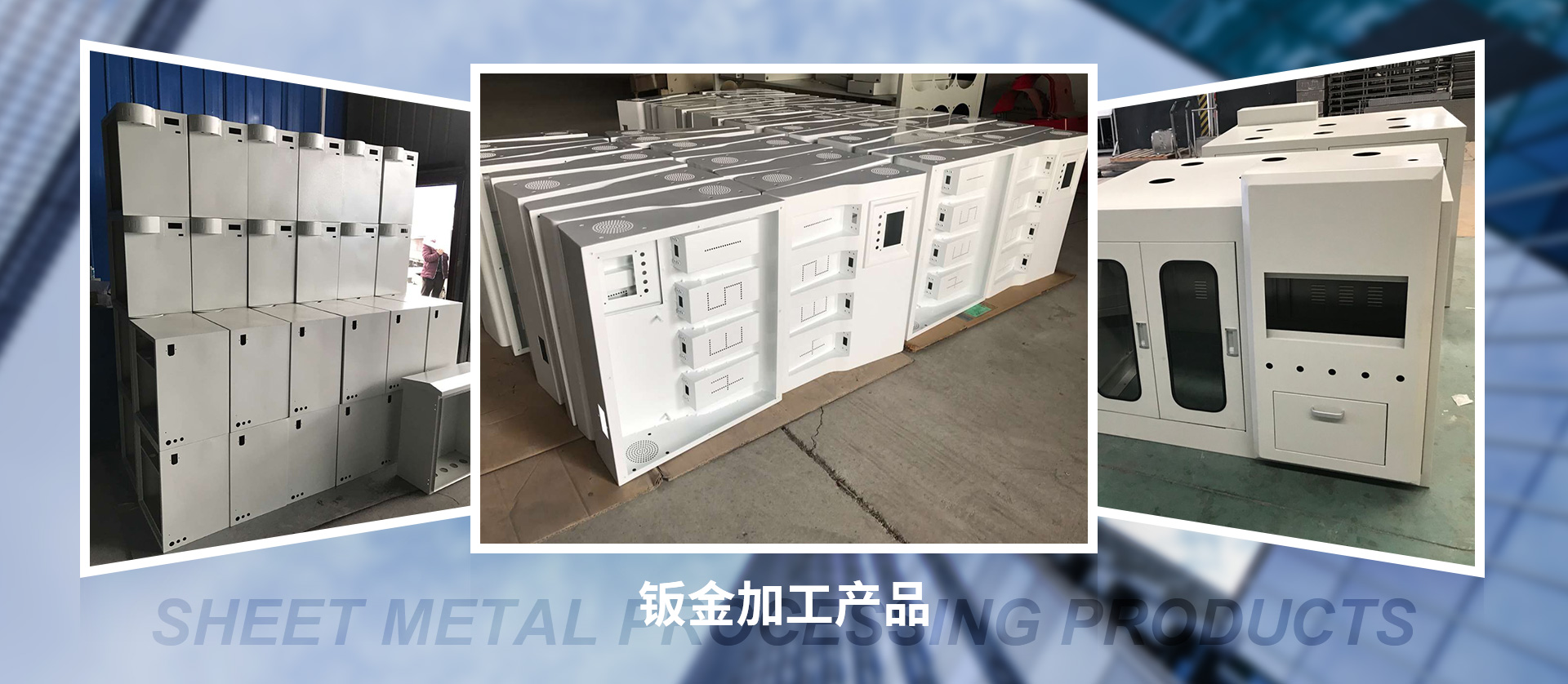

成都同富金屬制品有限公司,是以鈑金制品為主,不銹鋼制品為輔的生產(chǎn)廠(chǎng)家。

本公司具有雄厚的技術(shù)力量及優(yōu)異的生產(chǎn)工藝,業(yè)務(wù)涉及軌道、交通、通訊、安防,電教,電氣、自動(dòng)化設(shè)備、廣告等多個(gè)行業(yè)。主要業(yè)務(wù)包括中低壓設(shè)備配件及箱柜、電力設(shè)備、通訊設(shè)備、各類(lèi)電子機(jī)箱、機(jī)柜、電視墻、操作臺(tái)、電教臺(tái),廣告字幅、LED箱體以及非標(biāo)精密鈑金結(jié)構(gòu)件。此外有非標(biāo)產(chǎn)品開(kāi)發(fā)、設(shè)計(jì)承接任何板金設(shè)計(jì)及加工等服務(wù)。此外有非標(biāo)產(chǎn)品開(kāi)發(fā)、設(shè)計(jì)承接任何板金設(shè)計(jì)及加工等業(yè)務(wù)。

了解更多

-

01鋼制講臺(tái)電教臺(tái)

01鋼制講臺(tái)電教臺(tái) -

02鋼制講臺(tái)電教臺(tái)

02鋼制講臺(tái)電教臺(tái) -

03鋼制講臺(tái)電教臺(tái)

03鋼制講臺(tái)電教臺(tái)

新聞中心 / news center

06

May

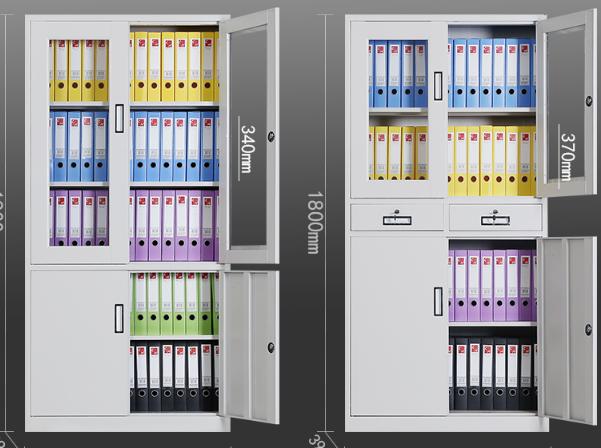

工程文件柜是由冷軋鋼板通過(guò)一套完好精細(xì)的制造工序完結(jié)的柜子,首要用于放置、文件、材料、以及各類(lèi)檔案物品。文件柜用途多,壽命長(zhǎng),那么它的生產(chǎn)流程是怎樣的呢?1、制品:制品包裝2、拼裝:拼裝門(mén)和鑰匙等3、沖壓:沖出折角邊和把手位等。4、點(diǎn)焊:點(diǎn)焊加固。分處焊和加焊。

查看全文>>

了解更多

文件柜的類(lèi)別:依照功用具體來(lái)分一般包括資料柜,密集柜,圖紙柜,更衣柜,儲(chǔ)物柜,鑰匙柜,鞋柜,職工柜等訂做的鐵皮柜。依照資料來(lái)分的話(huà)有平開(kāi)文件柜,板式文件柜,實(shí)木文件柜,不銹鋼文件柜。一般辦共用的都是以鋼制的文件柜為主,家庭用的一般是板式文件柜,奢華一點(diǎn)尊顯

近日,在綠榕南路與潮汕公路交界路口,一臺(tái)配電箱的大門(mén)敞開(kāi)著,箱內(nèi)電線(xiàn)、電器元件裸露,配電箱一側(cè)被肆意涂鴉。由于配電箱位于人行道旁,存在安全隱患,希望有關(guān)部門(mén)盡快修復(fù)。

數(shù)據(jù)中心內(nèi)設(shè)備眾多,內(nèi)部雖然有完善的空調(diào)系統(tǒng),但實(shí)際上內(nèi)部溫度分布是不夠均衡的。即便現(xiàn)在的數(shù)據(jù)中心部署了出入通風(fēng)道,機(jī)柜前面是入風(fēng)道,后面是出風(fēng)道,這樣可以及時(shí)將熱量帶走。不過(guò),由于不同的設(shè)備發(fā)熱功率是不同的,局部區(qū)域若放置有大功率設(shè)備,容易造成機(jī)房局部區(qū)域過(guò)熱

數(shù)據(jù)中心內(nèi)設(shè)備眾多,內(nèi)部雖然有完善的空調(diào)系統(tǒng),但實(shí)際上內(nèi)部溫度分布是不夠均衡的。即便現(xiàn)在的數(shù)據(jù)中心部署了出入通風(fēng)道,機(jī)柜前面是入風(fēng)道,后面是出風(fēng)道,這樣可以及時(shí)將熱量帶走。不過(guò),由于不同的設(shè)備發(fā)熱功率是不同的,局部區(qū)域若放置有大功率設(shè)備,容易造成機(jī)房局部區(qū)域過(guò)熱現(xiàn)象

據(jù)廣州海關(guān)統(tǒng)計(jì),2009年廣東省出口鋁材37 6萬(wàn)噸,比2008年同期(下同)下降36 2%;價(jià)值11億美元,下降42%。2008年下半年起,月度出口量基本呈V字形走勢(shì),2009年3月恢復(fù)緩慢回升,至下半年同比降幅逐月收窄,11月同比首現(xiàn)18 2%增長(zhǎng)后,12月增幅進(jìn)一步擴(kuò)大,當(dāng)月出口4 2萬(wàn)噸,大幅增

聯(lián)系我們

全國(guó)服務(wù)熱線(xiàn):

18161259656

聯(lián)系地址:

地址:成都市郫縣現(xiàn)代工業(yè)港港東二路820號(hào)

合作流程

聯(lián)系我司或找到公司主頁(yè),然后通過(guò)電話(huà)或在線(xiàn)咨詢(xún)您要購(gòu)買(mǎi)的產(chǎn)品信息!銷(xiāo)售人員通過(guò)您對(duì)所需產(chǎn)品的描述,有大致的了解,這時(shí)需要您傳真一份產(chǎn)品要求明細(xì)。通過(guò)明細(xì),對(duì)您所需產(chǎn)品有詳細(xì)的了解,然后給您報(bào)價(jià)。經(jīng)過(guò)協(xié)商,您對(duì)報(bào)價(jià)滿(mǎn)意,然后我們傳真一份合同給您。感覺(jué)合同滿(mǎn)意,簽字回傳,預(yù)付定金。

地址:

地址: